Choosing between Vendor Central and Seller Central will define how Amazon brands grow in 2026.

With Amazon tightening compliance and expanding automation rules, sellers must decide which path gives them the right balance of control, visibility, and profit.

Here’s what you need to know — and how CrazyVendor helps you win on both fronts.

Table of Contents

What is Amazon Seller Central?

How Seller Central works

Seller Central is Amazon’s platform for third-party sellers.

You list products, control pricing, and manage orders through FBA or FBM.

It’s flexible but hands-on, requiring accurate inventory control and quick responses to customers.

Pros of Seller Central

- Full control over pricing and promotions

- Direct customer communication

- Faster product feedback loops

Sellers handling multiple SKUs benefit from real-time inventory tracking powered by Inventory Management, which keeps quantities synced and avoids overselling.

Cons of Seller Central

You keep pricing control, but also handle customer service and returns.

CrazyVendor’s Customer Service Management automates order messages and feedback updates so sellers can protect performance scores without manual effort.

What is Amazon Vendor Central?

How Vendor Central works

Vendor Central is Amazon’s invitation-only portal for first-party suppliers.

You sell inventory directly to Amazon at wholesale rates, and Amazon resells to consumers.

For official details, see Amazon’s Vendor Central Overview.

Pros of Vendor Central

- Bulk purchase orders from Amazon

- Eligibility for Amazon’s retail marketing programs

- Greater listing exposure

Linking POs through Order Management lets vendors auto-track shipments and invoice confirmations without waiting for manual reconciliation.

Cons of Vendor Central

- Longer payment terms

- Limited pricing control

- Complex compliance requirements

With Profit Analytics, vendors can evaluate post-chargeback margins and see whether wholesale volume offsets reduced flexibility.

Vendor Central vs Seller Central: Key Differences

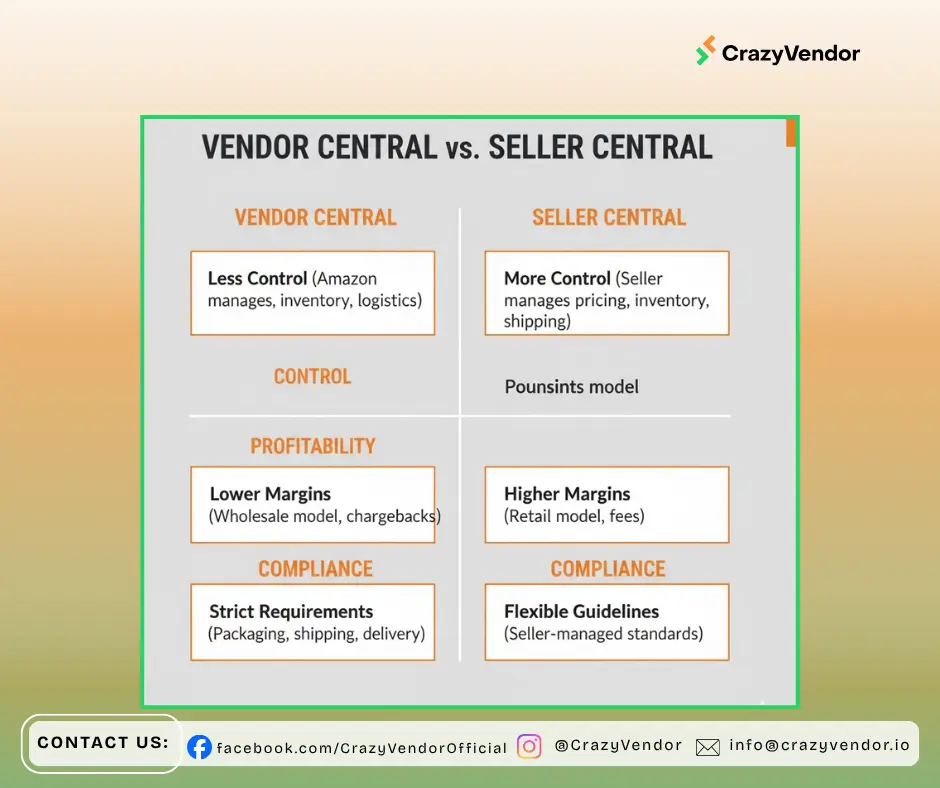

Control and ownership

Seller Central sellers own their listings and pricing.

Vendor Central vendors relinquish control to Amazon, which sets retail prices and manages delivery.

Profitability

Seller Central offers higher margins but higher operational costs.

Vendor Central offers scale but lower per-unit profit.

Profit Analytics reveals which model protects long-term margins under 2026 conditions.

Compliance and logistics

Seller Central uses FBA or FBM; Vendor Central requires EDI, labeling, and ASN accuracy.

CrazyVendor’s workflow tools minimize labeling mistakes and shipment rejections.

For more on how compliance evolved, read Amazon Ends Commingling: What Changes for QC and Returns.

Customer relationship

Seller Central sellers keep direct access to buyers.

Vendor Central vendors rely on Amazon’s systems.

Customer Service Management bridges that gap by automating communication where policies allow.

Why Multichannel Listings Will Redefine Amazon Selling in 2026

The future of Amazon selling isn’t either/or — it’s both.

In 2026, more brands will operate hybrid accounts, mixing Vendor Central’s scale with Seller Central’s control.

Multichannel Listings unifies SKUs, ASINs, and pricing across both accounts plus Walmart and Shopify.

Update once, and every channel stays aligned — no duplicates, no mismatched data, no compliance flags.

Watch how it works

With one dashboard, CrazyVendor’s Multichannel Listings will help 2026 sellers reduce listing errors, speed up updates, and maintain consistent catalog quality everywhere.

Which platform will dominate in 2026?

Amazon will keep both systems active.

Seller Central will remain the entry path for emerging brands, while Vendor Central will expand for manufacturers and wholesalers.

The winners will be those who automate across both.

Check out Master Amazon Vendor Central to Boost 2026 Sales for deeper insights on how automation reshapes vendor workflows.

By pairing that strategy with Multichannel Listings, sellers can forecast demand and manage hybrid models efficiently.

FAQs on Vendor Central vs Seller Central

Will Seller Central disappear in 2026?

No — Seller Central will continue supporting small and midsize sellers, while Vendor Central will scale for larger suppliers.

Can a brand have both accounts?

Yes. Hybrid setups will grow as more sellers use automation tools to handle cross-account operations seamlessly.

Which model is more profitable?

It depends on product type and volume.

Profit Analytics helps calculate true profitability after logistics and deduction costs.

How does automation simplify management?

Automation cuts manual uploads, syncs listings, and standardizes reporting — letting teams handle both systems in less time.

Conclusion

In 2026, the smartest brands won’t pick sides between Vendor Central and Seller Central — they’ll connect them.

CrazyVendor makes that possible with unified tools that automate listings, track orders, and reveal real margins across every channel.

With Inventory Management, Order Management, Profit Analytics, and Multichannel Listings, sellers will turn Amazon’s complexity into clarity — scaling faster, staying compliant, and winning in 2026.

Related Reading

- Master Amazon Vendor Central to Boost 2026 Sales

- Amazon Ends Commingling: What Changes for QC and Returns

- FNSKU Labeling Guide for Amazon Sellers

- Automate Customer Messages for Better Seller Ratings

- 7 Quick Label Printing Tips for Busy Sellers

You can also follow us on social media for more e-commerce insights and updates